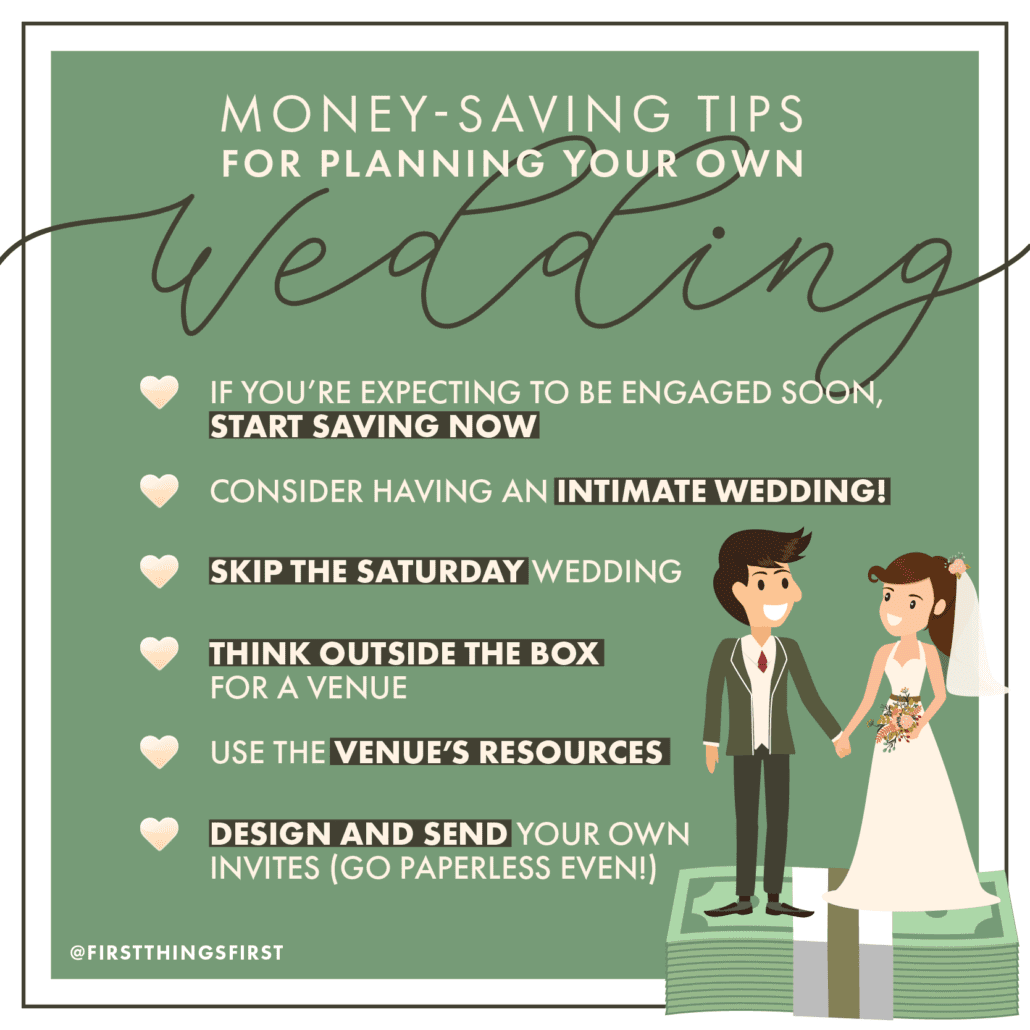

Money-Saving Tips for Planning Your Own Wedding

Prioritizing your marriage over your wedding is a beautiful place to grow from. While you dream of, save for and plan the wedding day, it can be magical without hurting you financially. You’ll have some of the same conversations you had while planning your wedding when you talk about preparing for marriage. Those “money-saving” talks for the big day can lead you to some great ideas after the wedding.

It wouldn’t surprise me if you talked about:

- Cutting down on how often you eat/drink out

- Combining music/streaming subscriptions

- Buying used things vs. buying new

- Setting saving goals

- Packing your lunch

- Paying off debt

- Asking friends and family if they have something you need

Gottman Institute research shows that one of the biggest reasons couples fight is… money. You can avoid this by getting on the same page and goal-setting together! Talk about how you spend and how you can save as a team… you’ll align your priorities, practice making important decisions together and strengthen your relationship. It’s a win-win.

Let’s get down to business. Here are some great bits of advice to help you save money on your wedding from NerdWallet and my own wedding experience!

Money-Saving Tips for Planning Your Wedding:

If you think you’ll get engaged soon, start saving ASAP.

My husband and I looked at our monthly income and cost of living and found areas where we could save. Some months we saved $500 each – some $300. Figure out what works best for you. Starting a few months before the engagement allowed us to pay for things as we made decisions. And we knew we had stability from the get-go.

Consider having an intimate wedding!

COVID-19 made guests joining in over Zoom or Facebook Live sexy. You can save on food, beverages, a DJ, venue, and extra hours from photographers. You can also save on the rehearsal dinner with extended family, bridesmaids and groomsmen. That savings can go straight into investing in your marriage! Maybe you can put what you were willing to pay for a bigger wedding into an emergency or fun fund instead!

Skip the Saturday wedding.

Planning your wedding for a Sunday or weekday can save you thousands! (My husband and I saved $1.5k by having a Sunday wedding!)

Think outside the box for a venue.

Vacation home, someone else’s property, government-owned historical sites, restaurants, State Parks (so affordable), etc.

Use the venue’s resources.

Using a venue that offers chairs and tables is a huge plus! Ask what’s included.

Design and send your own invites. Go paperless for the younger friends!

Canva has tons of free designs. The two best pro-tips I can give are sending formal invites to those who aren’t as tech-savvy and emailing the rest.

Here’s part 2: Use Staples if you decide to print. Upload your design as a postcard instead of as an invitation! It cost us around $48 for 250 “Save the Dates.” Postcard postage costs less, too! We did the same things with our invitations but put them in an envelope and used the back for more info. (P.S. The average cost for stationery/postage items like those listed is over $400… I just told you a way to do both for about $100). My wedding planner book told me to budget $800?!?

Buy wholesale flowers.

Putting your own arrangements together can save $150 alone on what people charge for making bridal bouquets!

Check the sale rack and wedding dress samples first!

Your dress won’t be any less beautiful if you get a great deal.

Borrow anything you can!

Accessories, centerpieces from married friends or family, decorations… anything!

Cut down on a store-bought cake.

Trust me, you don’t need as much cake as you think. Get a nice personal cake for you and your spouse to cut into. Ask friends and family to make the rest. This worked out beautifully for us.

Limit plus-ones.

If someone isn’t seriously dating, they don’t need one! On the flip side, you don’t have to invite someone’s significant other—especially if you aren’t close to them! Offering a plus-one for an out-of-town guest to travel with is thoughtful.

Be upfront with each other while planning your wedding. Figure out your priorities. Remember, your wedding day is the beginning, but your marriage is the rest of the story. One of the best reasons to save money on your wedding is to invest it in your marriage! Enjoy this season, but anticipate the sweetness that follows. Being married is just the best!! (I’m biased, but I’d like to think I’m also honest.)

Help! We fight about money all the time…

“Money, money, money. That’s all we seem to argue about.”

“She spends too much money at the grocery store on stuff we don’t need.”

“He always wants to eat out.”

“She’s always buying new clothes.”

“We’re not buying the furniture he wants. It costs too much.”

“He won’t let me loan my sister a few ($500) dollars.”

“She should get a better job.”

“He should get a better job.”

Countless marriage experts have documented that one of the top reasons couples give for divorce is – you guessed it – fighting about money. If that’s the case, why is the world’s richest couple, Jeff Bezos (founder and CEO of Amazon) and his wife, getting a divorce when they have all that money?

I’ve noticed in my 14 years of marriage that although we have had countless discussions, arguments and conflicts about money, wait for it… the issue isn’t really money. But if it’s not, then why do we fight about money so much? And why do we think it’s about money?

First, let’s recognize that every couple is different and there is no blanket answer. However, we know that our spending habits often reflect what we value. And if we disagree about what we should spend money on, then we disagree about what we value. And what I value is at the core of who I am and no one has the right to tell me what I should or shouldn’t value. Right?

For example, maybe I shop a lot because I value my appearance, because to look good is to feel good. Or maybe I value my independence and freedom and don’t like to feel controlled. Maybe I want to spend as little money as possible because I need to feel secure and if there’s no money in the bank, then I feel insecure. The issue wasn’t money in any of those instances. Instead, it was the symptom of a deeper issue.

If you feel like you’re fighting about money all the time, here are three things that can help:

- Start with understanding what you value and your attitude toward money. There are tons of resources you can use, but I think Sybil Solomon’s Money Habitudes can really help you gain insight into your own personal habits and attitudes toward money. Check it out, and trust me when I say that your marriage will thank you.

- Don’t forget to add in a little lightheartedness. Things like this Financial Would You Rather game from Annuity.org can help you get the ball rolling about some important conversations while keeping it fun.

- Don’t make assumptions. Do ask questions. I’ve learned to ask some simple questions when we discuss money matters in my marriage. When my wife I disagree about a purchase, I may humbly and non-judgmentally ask, “Why is that particular purchase/outing or whatever important to you? Help me understand.” I’ve learned a lot from that question. And it doesn’t mean that we always end up buying it. But now we are communicating and understanding what we value, not just what we want to spend money on.

- Seek to understand. (Did I mention that being humble really helps?) Perhaps your spouse has already spent money on something you believe was unwise, and you’re really unhappy about it. Before you accuse them and tell them they were irresponsible, inconsiderate or uncaring, check your own attitude first. Take a deep breath and ask why they thought that purchase or expense was so important at the moment. Humility + a non-judgmental attitude = Progress

Being humble and staying out of the judgment zone when it comes to spending can be a major win because the right attitude communicates that we care deeply about our partner, and NOT just about the topic at hand. Plus, moving past the symptom to the deeper issue is a major accomplishment you can both feel good about.

***If you or someone you know is in an abusive relationship, contact the National Hotline for Domestic Abuse. At this link, you can access a private chat with someone who can help you 24/7. If you fear your computer or device is being monitored, call the hotline 24/7 at: 1−800−799−7233. For a clear understanding of what defines an abusive relationship, click here.***

“I had no idea how much planning was involved in getting married,” remembers Amy Carter. “On top of surviving wedding planing, my fiancé and I were trying to sell my condo so I could move to Nashville. Fortunately, both of our families were very supportive of us as we planned for our big day. I was surprised how much my mother and I agreed on details of the wedding.”

Carter is lucky. Many couples preparing for their wedding day find themselves between a rock and a hard place by trying to please their parents, siblings, friends, grandparents and others who have an opinion on how the wedding should go. One bride’s mother refused to help because her daughter preferred a small and intimate wedding instead of a large formal affair.

Most experts agree that planning for a wedding is something most brides and their moms look forward to. Things can get a bit sticky, though. But don’t fear; there are some things you can do to help avert bitter feelings.

First and foremost, this is your day. Others may give their opinion about how things should go, but ultimately the bride and groom get to have the final say.

“We are probably different than most couples because we were more concerned about doing it the way that made us comfortable instead of being so concerned with stepping on toes,” says Rebecca Smith. “We set the rules early.

“There were certain things that I really didn’t care about, like the flowers. When my mom asked me what I wanted, I told her whatever she picked out would be fine. For us the overriding theme was we are incredibly excited about being married. We don’t want our focus on the wedding to be more than our focus on our marriage.”

At some point during the planning process, Rebecca and her fiancé acknowledged that something could go wrong. They eventually realized it really didn’t matter because they would still be married. They didn’t pursue a perfect production.

According to the experts, the Smiths would get an “A” in wedding planning.

Here are some additional tips to help you survive wedding planning:

- Decide what matters most to you. You can’t give 100 percent of your attention to everything, so decide where you want to focus and delegate the other things. This is a great way to involve family members without feeling like they are trying to control your day.

- Decide on a realistic budget. Although the average wedding today costs between $20,000 – $25,000, couples can have a beautiful wedding for significantly less money. Since money is the top area of conflict for couples, one way to begin your marriage well is to be realistic about your finances. Know what you and your family can comfortably afford. The amount of money spent is not a determining factor in the success of your marriage.

- Plan for your marriage. It is easy to get so caught up in your wedding planning that you neglect to plan for your marriage – all those days after the wedding. Take time out to attend premarital education classes or a marriage seminar. Read a good book together, like Fighting for Your Marriage: A Deluxe Revised Edition of the Classic Best-seller for Enhancing Marriage and Preventing Divorce or Before “I Do”: Preparing for the Full Marriage Experience. Your marriage will be stronger if go into it with your eyes wide open.

- Enjoy this time. Even though the preparation may be a bit stressful, schedule your time so you can truly enjoy these special moments. For many, this is a once in a lifetime experience. Instead of looking back at a whirlwind of activity that you really don’t remember, take non-essential things off the calendar. Rest adequately, eat well and don’t let others steal your joy.

Everywhere you turn these days it seems everybody is talking about the economy and its impact. Financial experts often discuss the dangers of people living beyond their means, and it seems that many are reaping the consequences of doing so. But despite the financial woes, is it all bad?

Clearly families are getting hit hard. Studies indicate that for years now, close to 43 percent of American families have spent more than they earned, buying anything they wanted. Now, they are being forced to rethink their spending habits – and it is incredibly painful.

Research shows that although money is not the number one thing couples consider when planning to marry, it is the number one thing they argue about.

Instead of being happily married, they find themselves arguing about spending habits, credit card debt and unpaid bills.

An analysis of Federal Reserve statistics in early 2015 revealed that the average U.S. household owes $7,281 on their credit cards. Average indebted households carry $15,609 in credit card debt.

When it comes to spending money, the temptations are plentiful – shiny new cars with the latest gadgets, flat screen televisions, traveling sports leagues, private schools, a new house, surround sound systems, trendy clothing, iPhones – and the list goes on.

Believer it or not, emotions typically drive spending decisions instead of affordability.

When it comes to money, a lot can be said about the value of self-discipline and saving to purchase certain items or participate in an activity.

People often complain that family members are like ships passing in the night because of busyness. Maybe the upside of an uncertain economy is that people might step back and evaluate what really matters.

When asked what is most important in life, people consistently say “family” is the single most important priority; yet their lives indicate that money and things are number one.

These ideas can help you make family a higher priority than money.

- Focus on building strong, healthy relationships instead of empires. Children spell love T-I-M-E, not T-H-I-N-G-S. There is no downside to living within your means – both financially and time-wise. It could actually mean less stress, more family time, less maintenance, more downtime, fewer arguments and stronger relationships.

- Evaluate all of your family activities. Find ways to exercise together, not apart. Exchange gym fees, travel sports and golfing alone to play with the family instead. Instead of paying to play, choose free family hobbies like playing tennis, biking or hiking. It will save you money and time.

- Learn how to control your finances instead of letting them control you. Many people believe that more money, a bigger house, and tons of toys are necessary for happiness. Money and toys are no substitute for time, so spend time with the people you love.

- Look for opportunities to encourage your loved ones and affirm them as a person worthy of your love.

When you look back on an economic crisis, perhaps you will see that less of some things is more of the best things. You may also see that many of the best things in life truly are free.

Image from Unsplash.com

A friend’s Facebook post that said expensive wedding rings lead to less marriage stability caught Randal Olson’s eye.

“My girlfriend and I had recently talked about wedding rings,” says Olson. “She said she did not want a big wedding ring. After reading the study, I was thankful. I am one semester away from graduating with a doctorate in computer science. My focus is on research so I don’t take things at face value. As I read the study (A Diamond is Forever and Other Fairy Tales: The Relationship between Wedding Expenses and Marriage Duration), I ran across this huge table of many different factors that play a role in long-term marriage.”

Some of the findings make perfect sense to Olson, such as:

- Couples who date three years or more before their engagement are 39 percent less likely to divorce.

- The more money you and your spouse make, the less likely you are to ultimately file for divorce.

- Couples who never go assemble for religious reason are two times more likely to divorce than regular attenders.

Other findings, however, took Olson by surprise.

“I was pretty shocked to see that the number of people who attend your wedding actually has a huge impact on long-term marital stability,” Olson says. “Couples who elope are 12.5 times more likely to divorce than couples who get married at a wedding with 200 plus people. The more I thought about this, the more it actually made sense. Having a large group of family and friends who are supportive of your marriage is vitally important to the long-term stability of your marriage.”

These findings surprised Olson, too:

- There is a relationship between how much people spent on their wedding and their likelihood of divorcing. The findings suggest that perhaps the financial burden incurred by a lavish wedding leads to financial stress for the couple. Women who spent $20,000 or more on their wedding were 3.5 times more likely to divorce than their counterparts who spent less than half that.

- The honeymoon matters! Couples who went on a honeymoon were 41 percent less likely to divorce.

- A big difference in educational levels could lead to a higher hazard of divorce.

- If looks and wealth are an important factor in your decision to marry a person, you are more likely to divorce down the road.

“Some of my friends read these findings and commented that they were in the bad categories. They asked me if their marriage was doomed,” Olson says. “The answer to that is no, but according to this research, statistically they are more likely to run into challenges. I believe the biggest takeaway for someone considering marriage like myself, is this isn’t a list of do’s and don’ts. However, this was a very large study and the findings are worthy of consideration to help couples have a more stable marriage.”

“I think planning is the key,” he shares. “It takes a lot of work to plan a wedding. Put that same amount of effort into planning for your marriage.”

Who handles the money in your home? What kind of debt load do you carry? How often do you argue about spending money?

The 2009 State of Our Unions: Marriage in America research conducted by the National Marriage Project and the Institute for American Values, focused on money and marriage, including the influence that debt, assets, spending patterns and materialism have on marriage.

The findings indicate a strong correlation between consumer debt and marital satisfaction.

The study found that money matters are some of the most important problems in contemporary married life. Compared to other issues, financial disagreements last longer, are more salient to couples and generate more negative conflict tactics, such as yelling or hitting, especially among husbands.

Contributing researcher, Dr. Jeffrey Dew, professor of family studies at Utah State University, found that credit card debt and financial conflict are corrosive to marriages. Couples who report disagreeing about finances once a week are 30 percent more likely to divorce than couples who disagree about it a few times a month. Dew also found that couples with no assets were 70 percent more likely to divorce than couples with $10,000 in assets.

Interestingly, perceptions of how well one’s spouse handles money plays a role in shaping the quality and stability of family life in the United States. And, people who feel that their spouse does not handle money well report lower levels of marital happiness.

Materialist spouses are also more likely to suffer from marital problems. Materialistic individuals report more financial problems in their marriage and more marital conflict, whether they are rich, poor or middle-class. For these husbands and wives, it would seem that they never have enough money.

Maybe you’ve never given much thought to how you spend your money. Perhaps it never even occurred to you that what you are or are not doing with your money directly impacts the state of your marriage. Want a fun way to understand you and your spouse’s spending choices? Check out this Financial Would You Rather game from Annuity.org!

It’s never too late to make changes. Here are some suggestions from financial experts:

- Start with a conversation about your financial goals. If this is not something you can do by yourselves, consider attending a class on managing your finances.

- Put all of your financial documents in a central location and go through them as a couple.

- Track your spending. In order to make appropriate changes, you need to know where your money is going.

- Start an emergency fund. Even putting a small amount in each month can be a safety net when you need extra cash.

- Make a budget and commit to living within your means.

One of the secrets to marital bliss is making sure that you control the money together instead of letting money control you. There seems to be something powerful, even sexy, about working with your mate to control your finances.

Check out crown.org, daveramsey.com or MagnifyMoney.com for information on establishing a budget. You’ll also find information for reducing debt, eliminating unnecessary fees and saving for the future.

***If you or someone you know is in an abusive relationship, contact the National Hotline for Domestic Abuse. At this link, you can access a private chat with someone who can help you 24/7. If you fear your computer or device is being monitored, call the hotline 24/7 at: 1−800−799−7233. For a clear understanding of what defines an abusive relationship, click here.***

It’s the one thing most people never get enough of. Many believe it is the key to happiness. People still argue over it, whether they have a lot of it or not enough of it to make ends meet. What is IT? It’s MONEY, of course.

Less than a month into his marriage, Roger Gibson, author of First Comes Love, Then Comes Money, found himself in a very precarious situation. He bought a truck without telling his wife.

He thought she would love his brand new green truck. But the moment he saw the look on her face as he pulled in the driveway, he knew “love” was not the word to describe her feelings. As he saw his wife speechless for the very first time, he began to realize exactly what he had done.

He thought to himself, “She is probably thinking, ‘How can anyone go out and buy a brand new truck without first talking with his wife?’” Gibson managed to create a financial situation in a few short minutes that put terrible stress on their relationship. In hindsight, he describes this as one of the most painful and embarrassing moments of his life.

Money is the number one reason for stress in many marriages.

And according to 2013 survey by the Institute for Divorce Financial Analysis, financial issues are also responsible for 22% of all divorces. This makes it the third leading cause of divorce.

“The money marathon in marriage often takes on the character of a race,” says Gibson. “At times, the pressure can become too intense and many couples want to throw in the towel and quit before the finish line. Many young couples break all the rules ‘to get it all’ in the beginning. Instead of experiencing happiness in their marriage, they find themselves arguing about spending habits, credit card debt and unpaid bills. They overload themselves with debt, which can cause the ‘ties that bind’ to snap and knock you off balance.”

Just as in a marathon, you can’t start out full blast or you’ll never make it. Instead, get a map of the route and learn to pace yourself so you can make it to the finish line. A great way to start that conversation is with a fun, lighthearted game! Check out this Financial Would You Rather from Annuity.org to get started.

Creating a spending plan is key for couples. Spending money is always more fun than saving. A plan’s purpose, however, is to strike a balance between the two.

Believe it or not, intimacy can be driven by personal finances.

Budgeting your money helps you think about your dreams for the future. It’s also a reflection of where you want to go. Instead of fighting because you don’t know where you want to go, the plan provides security and brings you together.

If you want to get a handle on your money and your stress in marriage, Gibson suggests that you:

- Eliminate unnecessary debt.

- Actively manage your finances.

- Build an emergency account, a savings fund for short-term needs and a long-term savings plan.

- Spend less than you make.

- Stop impulsive spending.

“Prestige, people, possessions and pleasure: these are the things that drive us because that is how our culture drives us,” Gibson says. “Everything we do is a reflection of these four things. People who are fighting about money don’t have a proper perspective of what money is.

“Instead of viewing money as a means to accomplish a goal, they see it as a way to satisfy their immediate desires. Usually the result is that finances control us versus us controlling our finances. The way that you gain control is to make a plan and stick to it.”

***If you or someone you know is in an abusive relationship, contact the National Hotline for Domestic Abuse. At this link, you can access a private chat with someone who can help you 24/7. If you fear your computer or device is being monitored, call the hotline 24/7 at: 1−800−799−7233. For a clear understanding of what defines an abusive relationship, click here.***