Money-Saving Tips for Planning Your Own Wedding

Prioritizing your marriage over your wedding is a beautiful place to grow from. While you dream of, save for and plan the wedding day, it can be magical without hurting you financially. You’ll have some of the same conversations you had while planning your wedding when you talk about preparing for marriage. Those “money-saving” talks for the big day can lead you to some great ideas after the wedding.

It wouldn’t surprise me if you talked about:

- Cutting down on how often you eat/drink out

- Combining music/streaming subscriptions

- Buying used things vs. buying new

- Setting saving goals

- Packing your lunch

- Paying off debt

- Asking friends and family if they have something you need

Gottman Institute research shows that one of the biggest reasons couples fight is… money. You can avoid this by getting on the same page and goal-setting together! Talk about how you spend and how you can save as a team… you’ll align your priorities, practice making important decisions together and strengthen your relationship. It’s a win-win.

Let’s get down to business. Here are some great bits of advice to help you save money on your wedding from NerdWallet and my own wedding experience!

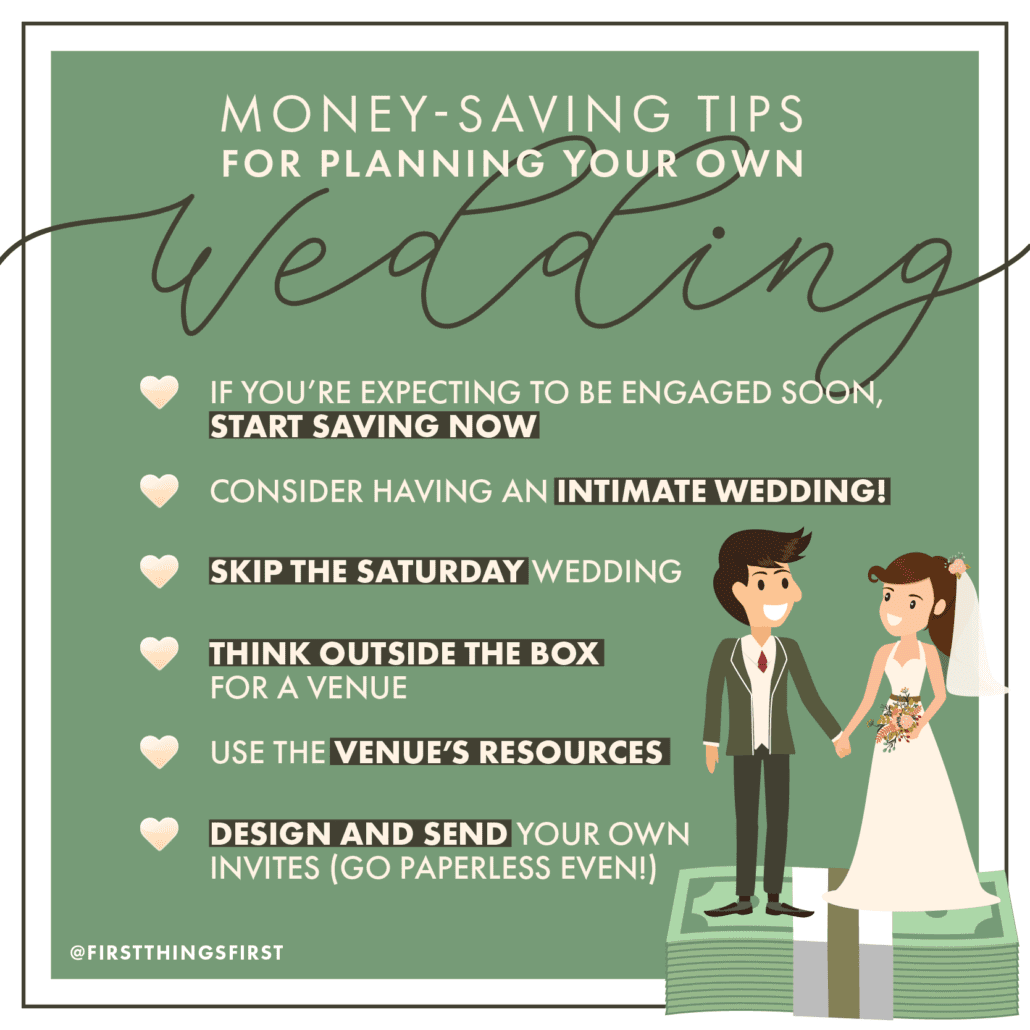

Money-Saving Tips for Planning Your Wedding:

If you think you’ll get engaged soon, start saving ASAP.

My husband and I looked at our monthly income and cost of living and found areas where we could save. Some months we saved $500 each – some $300. Figure out what works best for you. Starting a few months before the engagement allowed us to pay for things as we made decisions. And we knew we had stability from the get-go.

Consider having an intimate wedding!

COVID-19 made guests joining in over Zoom or Facebook Live sexy. You can save on food, beverages, a DJ, venue, and extra hours from photographers. You can also save on the rehearsal dinner with extended family, bridesmaids and groomsmen. That savings can go straight into investing in your marriage! Maybe you can put what you were willing to pay for a bigger wedding into an emergency or fun fund instead!

Skip the Saturday wedding.

Planning your wedding for a Sunday or weekday can save you thousands! (My husband and I saved $1.5k by having a Sunday wedding!)

Think outside the box for a venue.

Vacation home, someone else’s property, government-owned historical sites, restaurants, State Parks (so affordable), etc.

Use the venue’s resources.

Using a venue that offers chairs and tables is a huge plus! Ask what’s included.

Design and send your own invites. Go paperless for the younger friends!

Canva has tons of free designs. The two best pro-tips I can give are sending formal invites to those who aren’t as tech-savvy and emailing the rest.

Here’s part 2: Use Staples if you decide to print. Upload your design as a postcard instead of as an invitation! It cost us around $48 for 250 “Save the Dates.” Postcard postage costs less, too! We did the same things with our invitations but put them in an envelope and used the back for more info. (P.S. The average cost for stationery/postage items like those listed is over $400… I just told you a way to do both for about $100). My wedding planner book told me to budget $800?!?

Buy wholesale flowers.

Putting your own arrangements together can save $150 alone on what people charge for making bridal bouquets!

Check the sale rack and wedding dress samples first!

Your dress won’t be any less beautiful if you get a great deal.

Borrow anything you can!

Accessories, centerpieces from married friends or family, decorations… anything!

Cut down on a store-bought cake.

Trust me, you don’t need as much cake as you think. Get a nice personal cake for you and your spouse to cut into. Ask friends and family to make the rest. This worked out beautifully for us.

Limit plus-ones.

If someone isn’t seriously dating, they don’t need one! On the flip side, you don’t have to invite someone’s significant other—especially if you aren’t close to them! Offering a plus-one for an out-of-town guest to travel with is thoughtful.

Be upfront with each other while planning your wedding. Figure out your priorities. Remember, your wedding day is the beginning, but your marriage is the rest of the story. One of the best reasons to save money on your wedding is to invest it in your marriage! Enjoy this season, but anticipate the sweetness that follows. Being married is just the best!! (I’m biased, but I’d like to think I’m also honest.)

Who handles the money in your home? What kind of debt load do you carry? How often do you argue about spending money?

The 2009 State of Our Unions: Marriage in America research conducted by the National Marriage Project and the Institute for American Values, focused on money and marriage, including the influence that debt, assets, spending patterns and materialism have on marriage.

The findings indicate a strong correlation between consumer debt and marital satisfaction.

The study found that money matters are some of the most important problems in contemporary married life. Compared to other issues, financial disagreements last longer, are more salient to couples and generate more negative conflict tactics, such as yelling or hitting, especially among husbands.

Contributing researcher, Dr. Jeffrey Dew, professor of family studies at Utah State University, found that credit card debt and financial conflict are corrosive to marriages. Couples who report disagreeing about finances once a week are 30 percent more likely to divorce than couples who disagree about it a few times a month. Dew also found that couples with no assets were 70 percent more likely to divorce than couples with $10,000 in assets.

Interestingly, perceptions of how well one’s spouse handles money plays a role in shaping the quality and stability of family life in the United States. And, people who feel that their spouse does not handle money well report lower levels of marital happiness.

Materialist spouses are also more likely to suffer from marital problems. Materialistic individuals report more financial problems in their marriage and more marital conflict, whether they are rich, poor or middle-class. For these husbands and wives, it would seem that they never have enough money.

Maybe you’ve never given much thought to how you spend your money. Perhaps it never even occurred to you that what you are or are not doing with your money directly impacts the state of your marriage. Want a fun way to understand you and your spouse’s spending choices? Check out this Financial Would You Rather game from Annuity.org!

It’s never too late to make changes. Here are some suggestions from financial experts:

- Start with a conversation about your financial goals. If this is not something you can do by yourselves, consider attending a class on managing your finances.

- Put all of your financial documents in a central location and go through them as a couple.

- Track your spending. In order to make appropriate changes, you need to know where your money is going.

- Start an emergency fund. Even putting a small amount in each month can be a safety net when you need extra cash.

- Make a budget and commit to living within your means.

One of the secrets to marital bliss is making sure that you control the money together instead of letting money control you. There seems to be something powerful, even sexy, about working with your mate to control your finances.

Check out crown.org, daveramsey.com or MagnifyMoney.com for information on establishing a budget. You’ll also find information for reducing debt, eliminating unnecessary fees and saving for the future.

***If you or someone you know is in an abusive relationship, contact the National Hotline for Domestic Abuse. At this link, you can access a private chat with someone who can help you 24/7. If you fear your computer or device is being monitored, call the hotline 24/7 at: 1−800−799−7233. For a clear understanding of what defines an abusive relationship, click here.***